-

MEDIROM Healthcare Technologies Announces Acquisition of Japan Gene Medicine Corporation

Source: Nasdaq GlobeNewswire / 10 Jul 2024 15:22:08 America/Chicago

NEW YORK, July 10, 2024 (GLOBE NEWSWIRE) -- MEDIROM Healthcare Technologies Inc. (“we”, “our”, “us” or “the Company”) hereby announces that the Company plans to acquire a majority of Japan Gene Medicine Corporation (the “Target Company”). On June 30, 2024, the Company entered into a share transfer agreement (the "Share Transfer Agreement") to acquire 70.0% of the shares of the Target Company from an individual shareholder. The Company has also entered into a legally binding memorandum of understanding (the "Additional Transfer Memorandum of Understanding"), effective as of June 30, 2024, to obtain an option to acquire the remaining 30.0% of the Target Company’s shares from the seller. The closings of the transactions under the Share Transfer Agreement and Additional Transfer Memorandum of Understanding are each subject to certain conditions. Certain of these closing conditions under the Share Transfer Agreement are summarized below.

Japan Gene Medicine is a company engaged in the prenatal diagnosis business, providing genetic testing and analysis, and the company does business with major private, public and university hospitals in Japan. By understanding the condition of the fetus and the presence of any diseases or disorders, medical professionals can consider the most appropriate method of delivery and therapeutic education tailored to the condition of the fetus.

Although in other countries, especially in Europe and the United States, similar prenatal genetic testing services have become commonly available and utilized, in Japan, such services have not been common, with only 7.2% of pregnant women using such services in 2016.(*1)

Furthermore, in Japan and the Asian region at large, certain demographic trends point to Japan Gene Medicine’s significant growth potential. In the region, the childbearing age is increasing and the birthrate is declining rapidly therefore the potential need and benefits of genetic testing and analysis is increasing.

Kouji Eguchi, Chief Executive Officer, stated, “We believe that Japan Gene Medicine is one of the most competitive companies in the genetic testing and analysis services space and we expect future demand in Japan to grow rapidly. In the past, there has been insufficient marketing and education regarding such services and their value, which we believe presents a significant market opportunity.”

“We also believe there are significant synergies with our wellness salon business, Re.Ra.Ku®︎. Japan Gene Medicine’s target age group for women is in their 20s to 40s, which matches Re.Ra.Ku’s and will allow us to expand our service offering and improve our value proposition and customer experience.”

“The acquisition of Japan Gene Medicine is in line with our strategic objective to become a holistic healthcare company that provides comprehensive solutions and services for prevention and treatment. We obtain assets that further expand our presence in Japan and our commitment to grow in the Healthcare Technology industry. Japan Gene Medicine adds to our HealthTech solutions portfolio consisting of our on-demand training application “Lav®︎” that provides specific health guidance; our development and manufacturing of the world’s first smart tracker bracelet that does not require charging, “MOTHER Bracelet®”; and our deployment of our device-based monitoring system, “REMONY”.”

Share Acquisition from the Target Company and the Seller

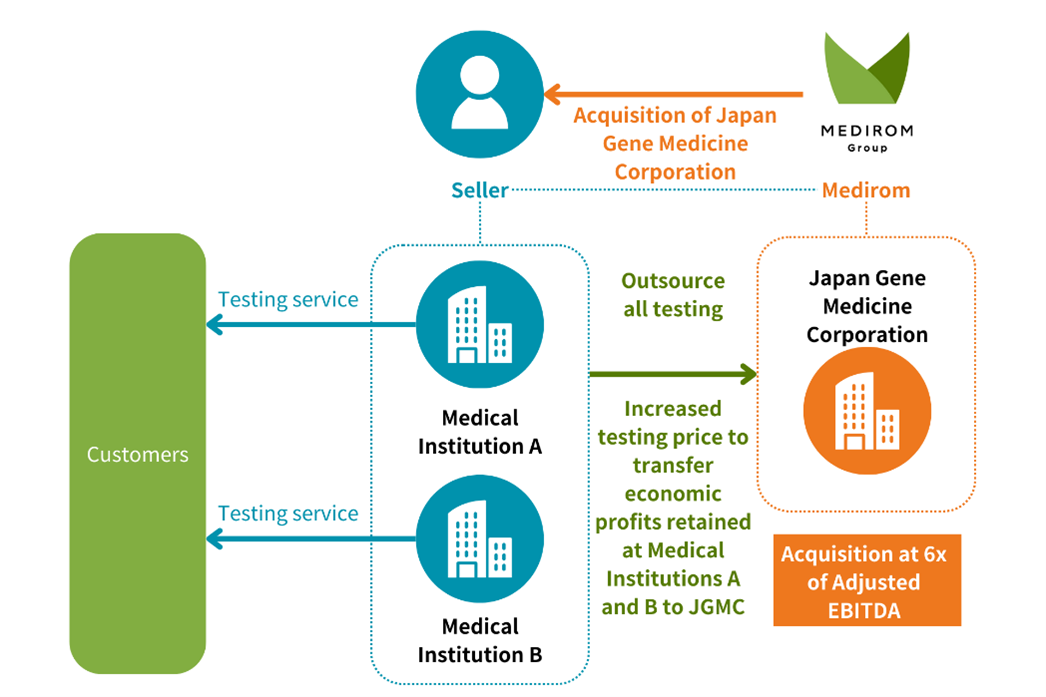

In addition to the prenatal genetic testing and analysis services provided by Japan Gene Medicine, two other companies that are substantially owned by the seller offer these services. Japan Gene Medicine, which owns the testing equipment, provides subcontracted testing and analysis services to these two companies. As a condition to the closing of the share transfer, the Japan Gene Medicine and such other two companies will conclude amended subcontracting agreements in forms reasonably satisfactory to us. Based on our negotiations with the seller, it is expected that such new subcontracts will revise the price of the subcontracted testing services so that substantially all the economic benefits of these services accrue to Japan Gene Medicine.

We have agreed with the seller on transfer consideration based on an enterprise value of six times Adjusted EBITDA(*2), which was calculated on an adjusted basis assuming that the aforementioned economic benefits had accrued to the Target Company for the one-year period ended December 31, 2023.

*1: Source: Aiko Sasaki, Haruhiko Sago et al: Trends in prenatal genetic testing in Japan 1998-2016, Journal of Japan Society of Perinatal and Neonatal Medicine 2018; 54:101-107.

*2: Adjusted EBITDA is defined as operating income plus depreciation, amortization of intangibles, and expenses incurred at the seller's direction other than for the purpose of operating the Target Company's business, with all such figures determined based on Japanese generally accepted accounting principles (“GAAP”).

Outline of the Transaction Stipulated in the Share Transfer Agreement.

Target Company Name of Company: Japan Gene Medicine Corporation

Head office: 15-9 Ichibancho, Chiyoda-ku, Tokyo

Incorporation date: December 17, 2019

Registered paid-in capital: 5,000,000 yen

Total number of shares issued: 500 shares of common stock

Total number of shares to be transferred: 350 shares of common stockTransfer Consideration Total price of 2,000,000,000 yen Assumptions and Calculation Methods for Transfer Consideration Two other companies substantially owned by the seller also provide prenatal genetic testing and analysis services, and the Target Company, which owns the testing equipment, provides subcontracted testing and analysis services to these two companies.

As a condition precedent to consummation of the share transfer, the terms and conditions of the subcontracted testing and analysis service agreements between the Target Company and the two companies substantially owned by the seller shall be amended in a form reasonably satisfactory to us. Based on our negotiations with the seller, it is expected that such agreements will be amended so that substantially all of the economic benefits from the genetic testing and analysis business accrue to the Target Company by increasing the price for the subcontracted services that the Target Company is contracted to provide.

Assuming hypothetically that such economic revisions had already been applied for the one-year period ended December 31, 2023, the Company and the seller calculated the Adjusted EBITDA (operating income plus depreciation, amortization of intangibles, and expenses incurred at the seller's direction other than for the purpose of operating the Target Company's business) for such one-year period, and applied a multiplier of 6 times to the Adjusted EBITDA to reach an enterprise value for the Target Company. The Company and the seller negotiated minor adjustments to that figure, which was then multiplied by 350/500 (70%) to reach the Transfer Consideration in the Share Transfer Agreement.Transaction Method Share transfer Seller Confidential (the seller is an individual) Sources of Funds and Transaction Structure The Company expects to finance the transaction using its own funds and borrowings.

A special purpose company to be established by the Company for the purpose of executing the share transfer (the “SPC”) will borrow funds from a financial institution for the purpose of the share transfer (the “LBO Loan”), pay the consideration for the Transfer, receive the shares subject to the share transfer from the seller, merge the SPC with the Target Company, and repay the LBO Loan with the Target Company's own cash flow under the leveraged buy-out structure.Scheduled Closing Date A date separately agreed upon by both the Company and the seller on which all of the conditions precedent to the closing of the share transfer have been satisfied and the share transfer can be effected. Other Conditions The closing of the share transfer under the Share Transfer Agreement is subject to the following conditions, among others:

- Revised or new contractual terms and conditions reasonably satisfactory to us are in place between the Target Company and two other companies substantially owned by the seller for subcontracted testing services.

- Receipt of a written commitment from a financial institution that it will provide a loan to the Company in an amount that exceeds 70% of the Transfer Consideration.

- The Additional Transfer Memorandum of Understanding shall have been executed and remains in force.

- Related party transactions between the Target Company and the seller have been resolved to the Company's satisfaction.

- Completion of procedures required under the Foreign Exchange and Foreign Trade Act of Japan.

Outline of the transaction as set forth in the Additional Transfer Memorandum of UnderstandingTarget Company Name of Company: Japan Gene Medicine Corporation

Head office: 15-9 Ichibancho, Chiyoda-ku, Tokyo

Incorporation date: December 17, 2019

Registered paid-in capital: 5,000,000 yen

Total number of shares issued: 500 shares of common stock

Total number of shares to be transferred: 150 shares of common stock

The Company will have an option to, subject to certain terms and conditions, preferentially acquire from the seller the remaining 150 the shares of the Target Company that are not subject to transfer under the Share Transfer Agreement.Transfer Consideration The amount shall be equal to 6 times (“Multiplier”) the adjusted EBITDA (operating income plus depreciation, amortization of intangibles, and expenses incurred for inter-company transactions with the Company and its subsidiaries) calculated from the financial reports of the Target Company for the same period included in the Group's published consolidated financial statements for the year ending December 31, 2026 (prepared in accordance with U.S. generally accepted accounting principles), less bank borrowings (excluding borrowings incurred by the Company in connection with the payment of the purchase price under the Share Transfer Agreement), adding cash and cash equivalents, and multiplied by 150/500 (30%). However, if the aforementioned adjusted EBITDA exceeds 930 million yen, the assumed Multiplier will be changed from 6 to 7. Transaction Method Share transfer Potential Closing Date Not later than June 30, 2027 Seller’s Buyback Right Upon the occurrence of any of the following events and subject to certain terms and conditions, the seller will have an option to repurchase 101 shares of the Target Company owned by the Company at the fair market value of such shares: (i) the Company records negative net assets for two consecutive fiscal years under its audited consolidated financial statements prepared under U.S. GAAP; (ii) the Company records negative net income for two consecutive fiscal years under the aforementioned financial statements; or (iii) the Company undergoes a substantial change in its management structure. 101 shares of the Target Company is currently equal to slightly more than one-fifth of the Target Company’s issued and outstanding shares, and the sale of such amount to the seller would be expected to make us a minority owner of the Target Company.

In addition, if we do not exercise the Company Option, the seller may demand that the Company sell back to the seller or its designee all or a portion of the shares of the Target Company held by us. In such case, the sale price for the shares will be the fair market value at the time the demand is made.

Forward-Looking Statements

Certain statements in this press release are forward-looking statements for purposes of the safe harbor provisions under the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements may include estimates or expectations about the Company’s possible or assumed operational results, financial condition, business strategies and plans, market opportunities, competitive position, industry environment, and potential growth opportunities. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “should,” “design,” “target,” “aim,” “hope,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “project,” “potential,” “goal,” or other words that convey the uncertainty of future events or outcomes. These statements relate to future events or to the Company’s future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance, or achievements to be different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond the Company’s control and which could, and likely will, affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects the Company’s current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to the Company’s operations, results of operations, growth strategy and liquidity. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements in this press release include:- the Company’s ability to obtain the necessary financing to complete the contemplated acquisition transaction on acceptable terms;

- the Company’s satisfactory completion of due diligence;

- the satisfaction of the conditions to close the acquisition, and the Company’s ability to consummate the transactions contemplated by the Additional Transfer Memorandum of Understanding;

- the Company’s ability to realize the anticipated benefits of the transaction;

- the Company’s ability to successfully integrate the acquired business;

- the Company’s ability to obtain necessary regulatory approvals;

- potentially significant transaction costs and unknown liabilities;

- the Company’s ability to achieve its development goals for its business and execute and evolve its growth strategies, priorities and initiatives;

- changes in Japanese and global economic conditions and financial markets, including their effects on the Company’s expansion in Japan and certain overseas markets;

- the Company’s ability to achieve and sustain profitability in its Digital Preventative Healthcare Segment;

- the Company’s ability to maintain and enhance the value of its brands and to enforce and maintain its trademarks and protect its other intellectual property;

- the Company’s ability to raise additional capital on acceptable terms or at all;

- the Company’s level of indebtedness and potential restrictions on the Company under the Company’s debt instruments;

- changes in consumer preferences and the Company’s competitive environment;

- the Company’s ability to respond to natural disasters, such as earthquakes and tsunamis, and to global pandemics, such as COVID-19; and

- the regulatory environment in which the Company operates.

More information on these risks and other potential factors that could affect the Company’s business, reputation, results of operations, financial condition, and stock price is included in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” and “Operating and Financial Review and Prospects” sections of the Company’s most recently filed periodic report on Form 20-F and subsequent filings, which are available on the SEC website at www.sec.gov. The Company assumes no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ from those anticipated in these forward-looking statements, even if new information becomes available in the future.

About MEDIROM Healthcare Technologies Inc.

MEDIROM, a holistic healthcare company, operates 307 (as of May 31, 2024) relaxation salons across Japan, Re.Ra.Ku® being its leading brand, and provides healthcare services. In 2015, MEDIROM entered the health tech business and launched new healthcare programs using an on-demand training app called “Lav®”, which is developed by the Company. MEDIROM also entered the device business in 2020 and has developed a smart tracker “MOTHER Bracelet®”. In 2023, MEDIROM launched REMONY, a remote monitoring system for corporate clients, and has received orders from a broad range of industries, including nursing care, transportation, construction, and manufacturing, among others. MEDIROM hopes that its diverse health-related product and service offerings will help it collect and manage healthcare data from users and customers and enable it to become a leader in big data in the healthcare industry. For more information, visit https://medirom.co.jp/en.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/260316ca-9935-41dd-bebd-7089819b2f01

Contact

Investor Relations Team

ir@medirom.co.jp